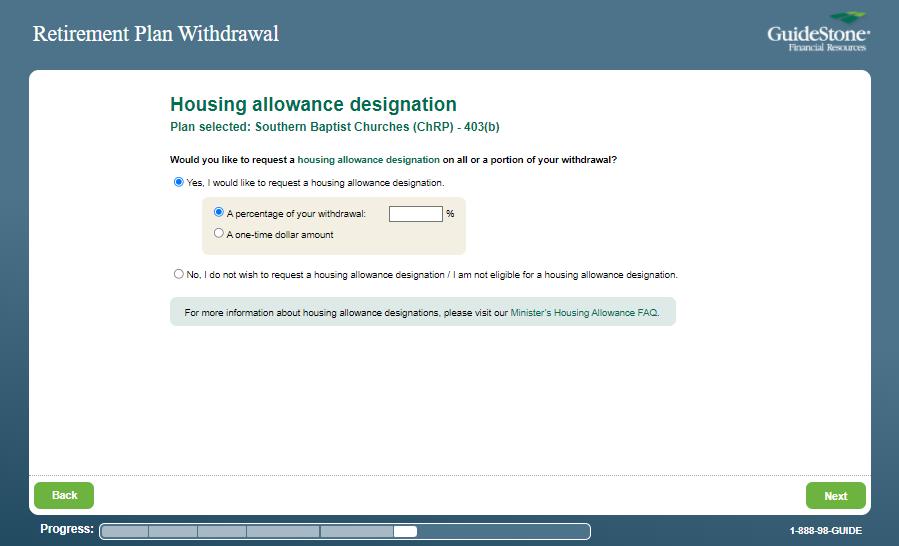

GuideStone makes the process very simple for ministers when withdrawing funds for a housing allowance. To ensure that your retirement account withdrawal is designated as a housing allowance, you just need to check the box in the online withdrawal application electing housing allowance, enter your dollar amount or percentage you wish to designate, and continue finishing the online withdrawal tool.

When it is time to begin preparing your taxes, GuideStone will send you a 1099-R tax form indicating that the withdrawal you requested was designated as a housing allowance and is not taxable. No taxes will be withheld from any amounts designated as a housing allowance.

For information on how to request a withdrawal online, take a look at our Withdrawal FAQ.